Quality of Earnings Report: Chime Financial, Inc.

This comprehensive analysis examines the quality and sustainability of Chime Financial's earnings following its June 2025 initial public offering, with particular focus on revenue composition, margin trends, and key risk factors affecting long-term profitability.

Executive Summary

Chime Financial, Inc. (NASDAQ: CHYM) presents a mixed quality of earnings profile characterized by strong revenue growth but significant structural vulnerabilities 1. The company achieved $1.67 billion in revenue for 2024, representing 31% year-over-year growth, while transitioning from a $25 million net loss to $13 million net income in Q1 2025 23. However, our analysis reveals concerning trends in margin compression, rising credit losses, and heavy dependence on regulated interchange fees that pose material risks to earnings sustainability 45.

Chime Financial Revenue Growth and Path to Profitability (2022-Q1 2025)

The analysis assigns Chime an overall quality of earnings score of 3.0 out of 5.0, indicating moderate quality with several areas requiring investor attention.

chime_quality_assessment.csvGenerated File

While the company demonstrates strong operational metrics including 8.6 million active members and $251 average revenue per active member (ARPAM), structural dependencies and regulatory risks warrant careful consideration 63.

Company Overview and Business Model

Chime operates as a financial technology company providing digital banking services through partnerships with FDIC-insured banks, primarily The Bancorp Bank and Stride Bank 7. Unlike traditional banks that generate revenue through net interest margins and fees, Chime employs a payments-driven, asset-light business model focused on interchange fee capture 18.

The company's value proposition centers on fee-free banking services targeted at underbanked consumers earning between $30,000 and $100,000 annually 9. This demographic represents approximately 75% of the adult U.S. population, providing Chime with a substantial addressable market estimated at $86 billion in annual revenue opportunity 1011.

Key operational metrics demonstrate strong customer engagement, with members averaging 54 transactions per month and 67% of active members using Chime as their primary financial relationship 26. The company processes approximately $115 billion in annual purchase volume, with 70% of transactions representing non-discretionary expenses such as groceries, utilities, and fuel 1012.

Revenue Quality Analysis

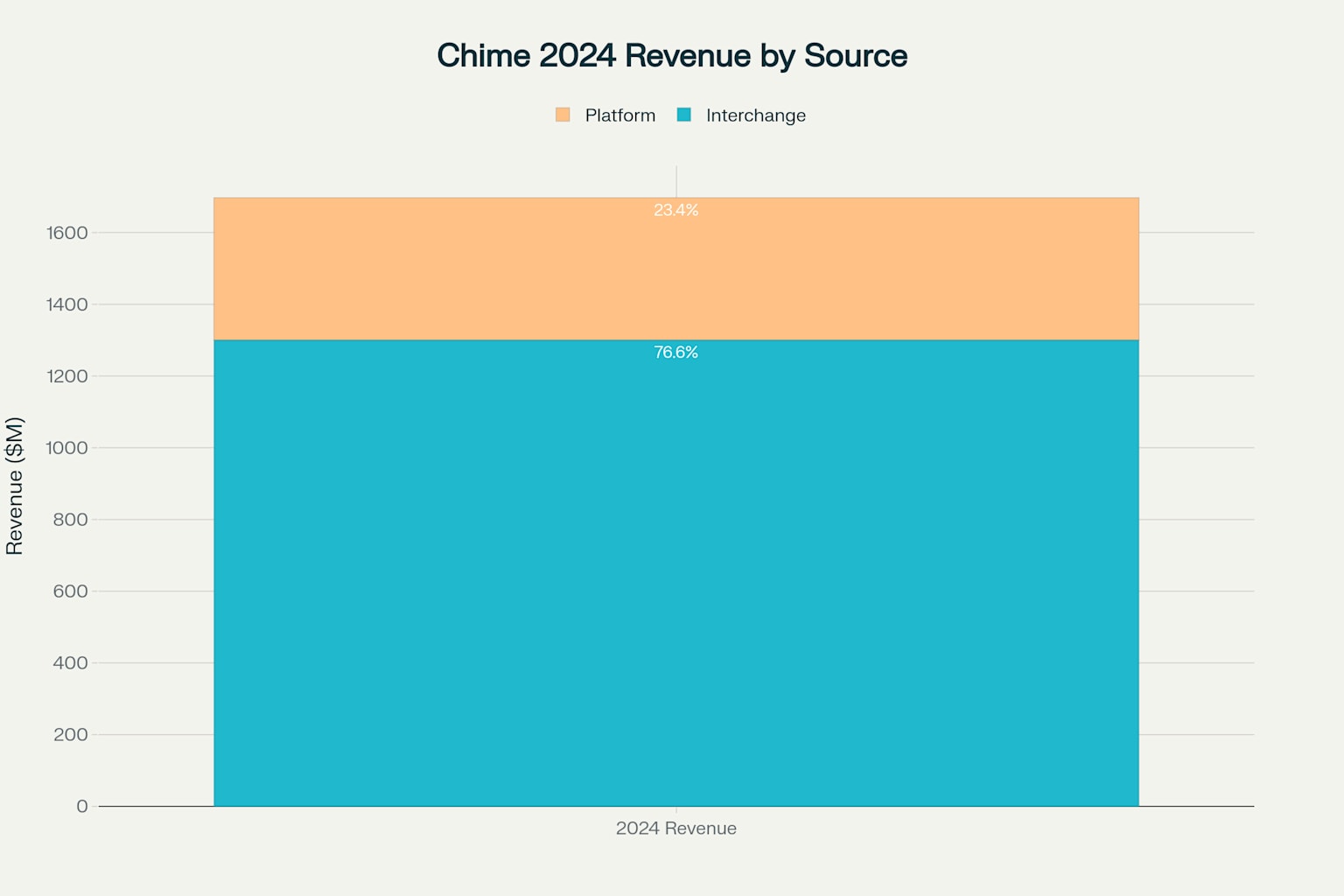

Chime's revenue composition reveals significant concentration risk that fundamentally affects earnings quality 5. Payments revenue, derived primarily from interchange fees, comprises $1.3 billion or 78% of total 2024 revenue, while platform revenue accounts for the remaining $397 million

chime_revenue_breakdown_2024.csvGenerated File

.

Chime Financial Revenue Composition - Heavy Dependence on Interchange Fees (2024)

This heavy dependence on interchange fees creates multiple quality concerns 105. First, the company benefits from the Durbin Amendment's small issuer exemption, which allows partner banks with less than $10 billion in assets to charge higher interchange fees than large banks 1314. If partner banks exceed this threshold, Chime's interchange revenue could decline by approximately 50% 54.

Revenue per active member (ARPAM) has grown from $245 in 2024 to $251 in Q1 2025, demonstrating modest improvement in customer monetization 16. However, this growth rate has decelerated compared to historical periods, suggesting potential maturation in per-customer revenue extraction.

chime_quality_metrics.csvGenerated File

The company's 97% net dollar purchase volume retention and 104% net dollar transaction profit retention indicate strong customer loyalty and engagement 1. Nevertheless, the concentration of 85% of revenue in interchange fees, where customers pay indirectly through merchant acceptance, creates sustainability questions as regulatory scrutiny increases 1015.

Profitability and Margin Analysis

Chime's margin profile reveals concerning deterioration despite overall revenue growth.

chime_performance_summary.csvGenerated File

Gross margin declined from 88% in 2024 to 85% in Q1 2025, while transaction margin compressed more significantly from 74% to 67% over the same period 1.

Chime Financial Key Quality Metrics Trends - Margin Compression Concerns

This margin compression primarily reflects the company's expansion into higher-loss rate products, particularly the MyPay earned wage access product and instant loans 14. Management explicitly acknowledged that transaction margin "will remain flat or decrease further in the near term" as these products scale 1.

Transaction and risk losses have increased dramatically, rising from 12% of revenue in 2024 to 21% in Q1 2025 4.

chime_risk_factors.csvGenerated File

The $54 million attributable to MyPay's full launch represents approximately half of Q1 2025's total $109 million in transaction and risk losses 4. This trend indicates that Chime's pursuit of product diversification comes at the cost of margin quality.

Chime Financial Transaction and Risk Losses - Deteriorating Credit Quality Trend

Operating leverage remains positive, with operating margin improving from 1.5% in 2024 to 2.5% in Q1 2025 despite margin compression. However, the sustainability of this trend depends heavily on the company's ability to control credit losses as lending products mature 4.

Cash Flow Quality Assessment

Chime's cash flow profile demonstrates improvement but remains volatile 1617. The company achieved positive free cash flow of $59 million in 2024, representing a significant improvement from negative $167 million in 2023 16.

chime_historical_performance.csvGenerated File

However, Q1 2025 showed negative free cash flow of $40 million, indicating seasonal variations and ongoing investment requirements 16.

Operating cash flow turned positive at $64 million in 2024 but declined to negative $34 million in Q1 2025 1617. This volatility partly reflects the company's continued investment in customer acquisition, with $1.4 billion spent on marketing from 2022 to 2024 2. Customer acquisition costs remain elevated at approximately $200 per customer, though retention rates exceed 90% once direct deposit is established 2.

The company's asset-light model provides operational flexibility, with minimal capital expenditure requirements of $5-10 million annually 16. However, working capital fluctuations related to transaction processing and partner bank settlements create quarterly volatility in operating cash flows 16.

Risk Factors and Regulatory Concerns

Chime faces several high-impact risks that directly affect earnings quality. The most significant concern involves regulatory dependency on the Durbin Amendment exemption, which could materially reduce interchange revenue if partner banks exceed asset thresholds 513.

Recent regulatory actions underscore compliance risks, including a $4.55 million settlement with the Consumer Financial Protection Bureau (CFPB) for delayed consumer refunds 18. This enforcement action demonstrates ongoing regulatory scrutiny and potential for additional compliance costs 18.

Credit risk management becomes increasingly critical as Chime expands lending products 4. The company's fraud rates decreased by 29% in 2024, but rising transaction losses in lending products indicate emerging credit quality challenges 4. Management's acknowledgment that MyPay loan losses contributed $54 million to Q1 2025 transaction losses highlights execution risks in credit underwriting 4.

Competitive pressure from traditional banks, neobank rivals like SoFi and Varo, and payment companies such as Block's Cash App creates ongoing market share risks 919. While Chime maintains market leadership with 22 million customers, increasing competition could pressure customer acquisition costs and retention rates 9.

Competitive Position and Market Outlook

Chime's competitive position remains strong within the neobanking sector, with significant scale advantages and brand recognition 920. The company's 8.6 million active members represent substantial market penetration, though less than 5% of its target demographic indicates continued growth potential 311.

The digital banking market is projected to grow at a 6.8% compound annual growth rate through 2029, reaching $2.09 trillion in net interest income globally 21. However, margin compression across the fintech sector and increasing regulatory scrutiny create headwinds for valuation multiples 2022.

Chime's asset-light model provides cost advantages relative to traditional banks, with 76% of Americans using mobile banking apps and continued branch closures creating market opportunities 2123. The company's focus on financial inclusion and fee-free services differentiates it from traditional competitors, though replication risks exist 9.

Quality of Earnings Assessment

Our comprehensive assessment assigns Chime a quality of earnings score of 3.0 out of 5.0, indicating moderate quality with significant concerns. Revenue quality scores lowest at 2.0 due to interchange fee concentration, while cost structure scores highest at 4.0 reflecting the asset-light operating model.

Key positive factors include consistent revenue growth, strong customer retention, and transparent financial reporting. However, material concerns around revenue sustainability, regulatory dependencies, and margin compression limit the overall quality assessment.

The company's path to profitability appears achievable based on Q1 2025 results, but sustainability depends heavily on controlling credit losses and maintaining interchange fee rates. Free cash flow volatility and seasonal variations in working capital create additional uncertainty for investors.

Conclusion and Recommendations

Chime Financial presents a complex quality of earnings profile that requires careful investor consideration. While the company demonstrates strong operational metrics and market position, structural vulnerabilities in revenue composition and margin trends pose material risks to long-term sustainability 15.

Key recommendations for investors include:

Monitor Regulatory Developments: Track Durbin Amendment modifications and partner bank asset growth that could impact interchange revenue 1314. Regulatory changes could reduce revenue by up to 50% if exemptions are lost 5.

Assess Credit Quality Trends: Closely examine transaction and risk losses as lending products scale, particularly given the increase from 12% to 21% of revenue in Q1 2025 4. Credit underwriting effectiveness will determine margin sustainability 4.

Evaluate Revenue Diversification: Monitor progress in reducing interchange fee dependency through platform revenue growth and new product development 110. Success in diversification will improve earnings quality scores over time.

The moderate quality of earnings score reflects Chime's position as a transitional growth company with both significant opportunities and material risks. Investors should weigh the company's strong market position and customer loyalty against structural revenue vulnerabilities and regulatory dependencies when making investment decisions.

- https://www.linkedin.com/pulse/chime-financial-s-1-breakdown-max-motschwiller-m9njc

- https://research.contrary.com/company/chime

- https://www.investors.com/news/technology/chime-ipo-stocks-fintech/

- https://www.tradingview.com/symbols/NASDAQ-CHYM/financials-income-statement/

- https://www.ainvest.com/news/chime-ipo-surge-signals-fintech-return-growth-payments-driven-models-stay-2506/

- https://www.cnbc.com/2025/06/12/chime-opens-at-43-in-nasdaq-debut-after-pricing-ipo-above-range.html

- https://www.sec.gov/Archives/edgar/data/868671/000119312512084958/d257028d10k.htm

- https://www.chime.com/newsroom/news/chime-files-registration-statement-for-proposed-initial-public-offering/

- https://www.chime.cpa/services

- https://www.pymnts.com/news/ipo/2025/chime-financial-files-for-ipo-sees-enormous-opportunity-to-grow/

- https://www.chime.com/about-us/

- https://investors.chime.com/sec-filings/sec-filing/s-1/0001628280-25-025059

- https://www.bankingdive.com/news/chime-files-for-ipo-sec-nasdaq-chym/748152/

- https://stockanalysis.com/stocks/chym/financials/cash-flow-statement/

- https://www.reuters.com/business/finance/chime-prices-us-ipo-27-per-share-raise-864-million-2025-06-11/

- https://www.tradingview.com/symbols/NASDAQ-CHYM/financials-cash-flow/

- https://www.pymnts.com/news/digital-banking/2025/chime-sees-86-billion-dollar-revenue-opportunity-amid-digital-banking-shift/

- https://paymentsinfull.substack.com/p/chime-s-1-still-not-the-future-of

- https://accountinginsights.org/how-does-chime-make-their-money-a-breakdown-of-revenue-streams/

- https://finance.yahoo.com/video/chime-ipo-cfo-explains-separates-171232833.html

- https://www.forbes.com/sites/jeffkauflin/2025/06/10/chimes-ipo-poised-to-pop-even-as-it-faces-long-term-challenges/

- https://www.reddit.com/r/chimefinancial/comments/1hfhczb/wtf_is_this_when_did_this_start_and_why_werent_we/

- https://www.consumerfinance.gov/about-us/newsroom/cfpb-takes-action-against-chime-financial-for-illegally-delaying-consumer-refunds/

- https://www.alpha-sense.com/blog/primer/chime-financial-neobanking-market/

- https://overtheanthill.substack.com/p/chime

- https://www.decodingdiscontinuity.com/p/chime-ipo-the-neobank-economics-test

- https://www.investopedia.com/terms/d/durbin-amendment.asp

- https://sdk.finance/what-is-digital-banking/

- https://www.tradingcalendar.com/post/chime-financial-ipo-what-to-expect-from-the-neobank-s-2025-debut

- https://www.bostonfed.org/-/media/Documents/Community-Development-Issue-Briefs/cdbrief22013.pdf

- https://www.firstbank.com/resources/learning-center/top-banking-trends-to-watch-in-2025/

- https://simplywall.st/stocks/us/software/nasdaq-chym/chime-financial/past

- https://simplywall.st/stocks/us/software/nasdaq-chym/chime-financial

- https://www2.deloitte.com/content/dam/Deloitte/us/Documents/audit/us-revenue-recognition-payments-pov.pdf

- https://www.finrofca.com/news/fintech-valuation-mid-2025

- https://trullion.com/blog/revenue-recognition-a-modern-approach-to-billing-challenges/

- https://www.ainvest.com/news/chime-ipo-litmus-test-fintech-valuations-post-pandemic-world-2506/

- https://finance.yahoo.com/quote/CHYM/financials/

- https://www.sec.gov/edgar/browse/?CIK=0001795586

- https://www.sec.gov/Archives/edgar/data/1795586/000162828025025059/chimefinancialinc-sx1wq1da.htm

- https://chimes.org/resources/financial-reports/

- https://www.sec.gov/Archives/edgar/data/1795586/000162828025028733/chimefinancialinc-sx1a.htm

- https://www.sec.gov/edgar/browse/?CIK=1625286

- https://www.nasdaq.com/market-activity/stocks/chym/sec-filings

- https://research.secdatabase.com/CIK/1795586/Company-Name/CHIME-FINANCIAL-INC.

- https://sacra.com/c/chime/

- https://www.forbes.com/sites/ronshevlin/2025/06/14/the-chime-ipo-will-kickstart-a-fintech-investment-comeback/

- https://www.fintechtris.com/blog/chime-bank-top-neobank-in-us

- https://www.ainvest.com/news/chime-financial-slumps-301st-trading-rankings-volume-drops-77-17-2506/

- https://seekingalpha.com/article/4794982-chime-financial-strong-public-debut