Quality of Earnings Report: Caris Life Sciences, Inc.

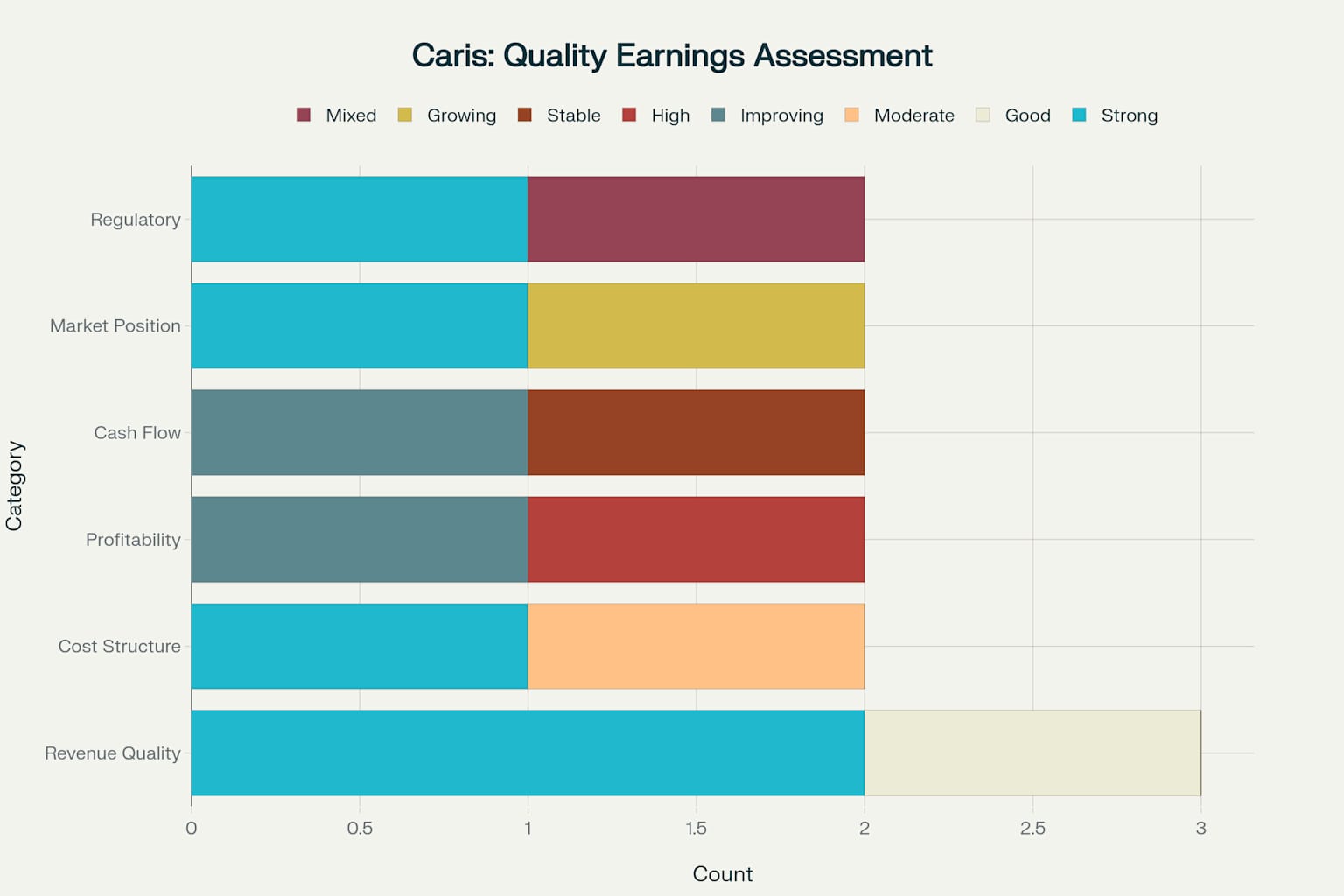

This comprehensive quality of earnings analysis examines Caris Life Sciences' financial performance, business model sustainability, and earnings quality through the lens of the company's pending initial public offering and rapid growth trajectory in the precision medicine sector. Our assessment reveals a company demonstrating strong operational improvements despite continued losses, positioned within high-growth addressable markets with significant competitive advantages.

Executive Summary

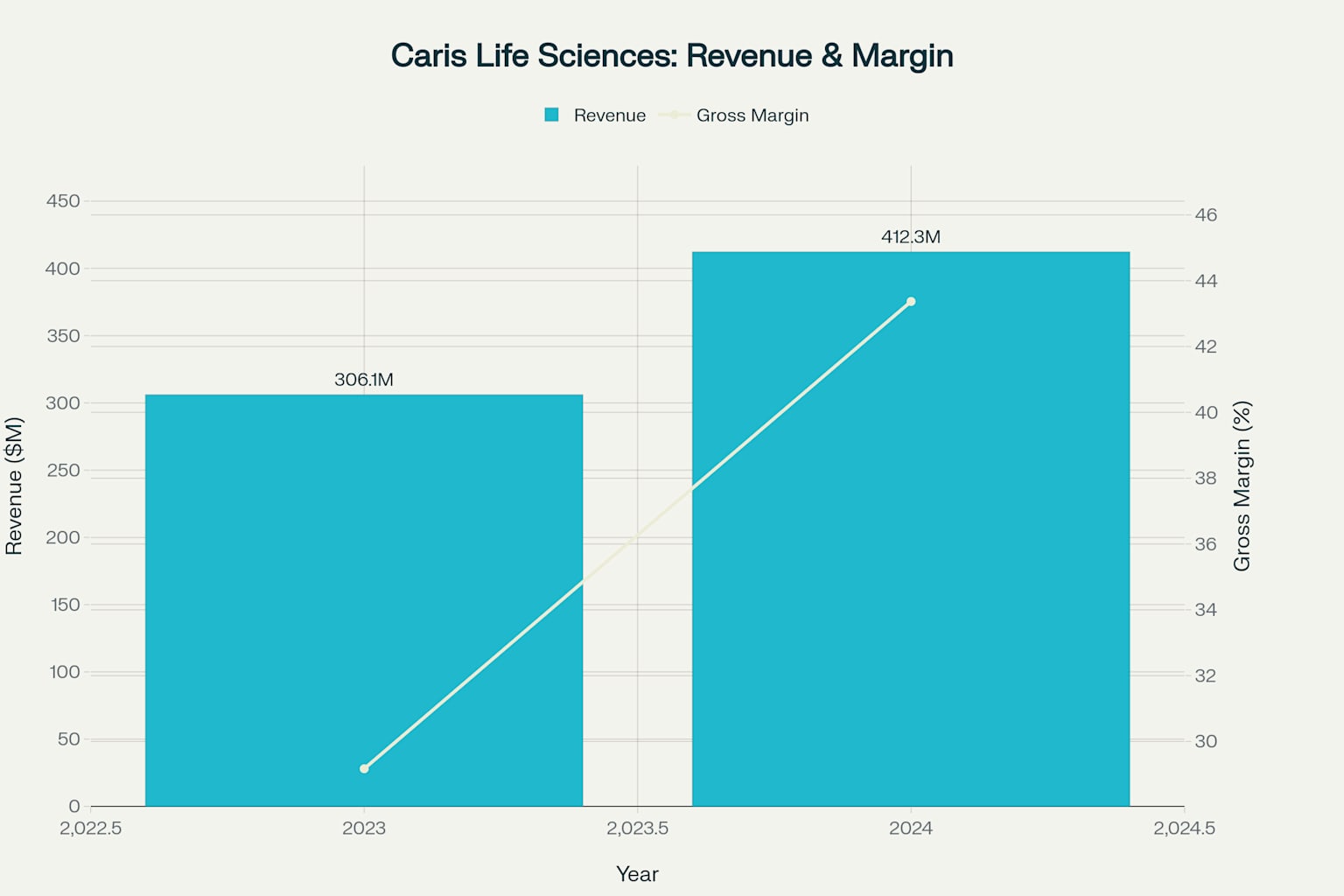

Caris Life Sciences exhibits strong quality of earnings characteristics driven by robust revenue growth, significant gross margin expansion, and improving operational efficiency 12. The company has demonstrated consistent revenue growth of 34.7% in 2024 and 50% year-over-year growth in Q1 2025, reaching $452.5 million in trailing twelve-month revenue 23. While the company remains unprofitable with substantial cash burn, improving margins and strong market positioning indicate a path toward profitability as the business scales 3.

Strong revenue growth accompanied by significant gross margin expansion demonstrates Caris' improving operational efficiency and scale benefits

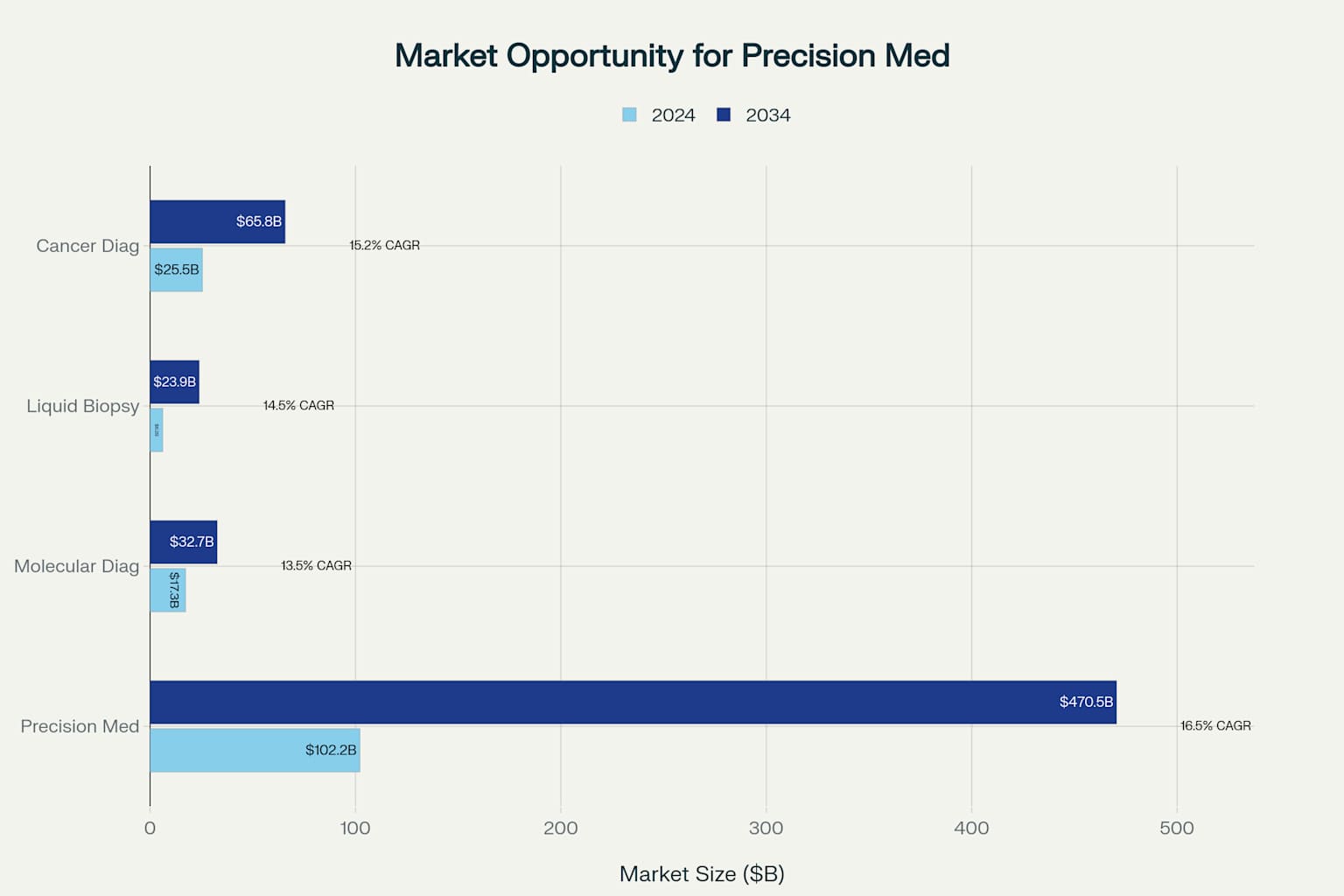

The precision medicine market opportunity provides substantial tailwinds, with addressable markets expected to grow from $151.2 billion in 2024 to $593.0 billion by 2034, representing a 14.6% compound annual growth rate 456. Caris' comprehensive molecular profiling platform and recent FDA approvals position the company to capture significant market share in this expanding sector 78.

Company Overview and Business Model

Founded in 2008, Caris Life Sciences operates as a next-generation AI TechBio company specializing in precision medicine and molecular profiling for cancer care 910. The company has built one of the largest multimodal databases combining molecular and clinical outcomes data, with over 580,000 matched patient records and growing 911. Caris has conducted more than 6.5 million tests across 849,000 cases, partnering with over 100 biopharmaceutical companies and thousands of practicing oncologists 212.

business_metrics.csvGenerated File

The company's business model centers on molecular profiling services that analyze genetic, genomic, proteomic, and immune system characteristics of patient tumors 12. Revenue streams primarily include tissue-based molecular profiling through MI Profile (estimated 70% of revenue), liquid biopsy services via Caris Assure (estimated 15%), pharmaceutical partnership services (10%), and international expansion (3%) 12. This diversified revenue base provides stability while positioning the company for growth across multiple high-value market segments.

Financial Performance Analysis

Revenue Growth and Sustainability

Caris has demonstrated exceptional revenue growth trajectory with strong sustainability indicators 12. The company's revenue increased from $306.1 million in 2023 to $412.3 million in 2024, representing 34.7% year-over-year growth 23. Trailing twelve-month revenue reached $452.5 million, indicating continued momentum into 2025 3. Q1 2025 revenue of $120.9 million compared to $80.7 million in Q1 2024 represents 50% year-over-year growth, demonstrating accelerating business expansion 113.

caris_annual_financials.csvGenerated File

The revenue growth is underpinned by strong operational metrics including 31% case volume growth in Q1 2025, expanding physician partnerships (7,400 active physicians), and growing biopharma collaborations (100+ partners) 112. This broad-based growth across multiple customer segments and geographies (65 countries served) indicates sustainable revenue expansion rather than concentrated customer dependency 11.

Gross Margin Expansion

One of the most compelling quality of earnings indicators is Caris' significant gross margin improvement 3. Gross margins expanded from 29.17% in 2023 to 43.37% in 2024 and further to 46.35% in the trailing twelve-month period 3. This 17-percentage-point improvement over two years demonstrates substantial operational leverage and scale benefits as the business grows.

The margin expansion reflects several positive factors: improved test automation and efficiency, higher-value service mix with increased liquid biopsy adoption, better pricing realization, and operational scale benefits 212. The company's comprehensive molecular profiling approach commands premium pricing compared to single-biomarker tests, supporting sustainable margin improvements 12.

Market Opportunity and Positioning

Addressable Market Analysis

Caris operates within multiple high-growth healthcare technology markets with substantial expansion potential 4514. The precision medicine market is projected to grow from $102.17 billion in 2024 to $470.53 billion by 2034 at a 16.5% CAGR 4. The molecular diagnostics market is expected to expand from $17.3 billion to $32.7 billion (13.5% CAGR), while the liquid biopsy market is forecast to grow from $6.18 billion to $23.94 billion (14.5% CAGR) 1415.

Large and rapidly growing addressable markets provide significant expansion opportunities for Caris' precision medicine platform

These market dynamics create a total addressable market exceeding $150 billion in 2024, growing to nearly $600 billion by 2034 45146. Caris' comprehensive platform approach positions the company to capture value across multiple market segments rather than being limited to a single diagnostic category.

Competitive Positioning

Caris competes in a fragmented but rapidly consolidating market with several key advantages 1615. Major competitors include Roche/Foundation Medicine (tissue-based comprehensive genomic profiling leader), Guardant Health (liquid biopsy leader), Exact Sciences (cancer screening), and emerging players like Tempus AI 1617. However, Caris differentiates through its comprehensive approach combining whole exome sequencing, whole transcriptome sequencing, and AI-driven insights in a single platform 92.

The company's competitive moat includes its extensive clinico-genomic database (580,000+ patient records), AI capabilities, regulatory approvals, and broad physician network 911. Recent FDA approval of MI Cancer Seek as the first simultaneous whole exome and whole transcriptome sequencing-based companion diagnostic strengthens Caris' regulatory position 7818.

Regulatory Environment and Recent Approvals

FDA Approvals and Market Access

A significant quality of earnings positive development was the November 2024 FDA approval of MI Cancer Seek as a companion diagnostic test 7818. This approval represents the first and only simultaneous whole exome and whole transcriptome sequencing-based assay with FDA-approved companion diagnostic indications for solid tumors 719. The test includes one pan-cancer and five tumor-specific indications for numerous FDA-approved therapies, available for both adult and pediatric patients (ages 1-22) 719.

This regulatory milestone provides several business benefits: enhanced reimbursement prospects, competitive differentiation, expanded market access, and validation of Caris' scientific approach 78. The companion diagnostic designation links specific biomarker results to FDA-approved therapies, potentially improving payer coverage and physician adoption 1918.

Reimbursement Challenges and Opportunities

Reimbursement remains a mixed factor in the quality of earnings assessment 202122. While precision medicine diagnostics face ongoing reimbursement challenges, recent trends favor coverage expansion for clinically validated tests 20. Medicare and major private payers have increased coverage for comprehensive genomic profiling, particularly for advanced cancer patients 2021.

The regulatory approval of MI Cancer Seek strengthens reimbursement prospects, as companion diagnostics typically receive more favorable coverage than laboratory-developed tests 2320. However, high test costs and inconsistent payer policies remain risks requiring ongoing management attention 2122.

Quality of Earnings Assessment

Revenue Quality Factors

Revenue quality assessment reveals predominantly positive indicators.

quality_of_earnings_factors.csvGenerated File

Revenue growth sustainability is rated strong based on consistent expansion across multiple metrics and customer segments 12. Customer diversification is good with over 7,400 physician partners and 100+ biopharma collaborations, reducing concentration risk 11. The recurring revenue model is strong, with established physician relationships and ongoing patient testing creating predictable revenue streams 12.

Cost Structure and Profitability

Cost structure analysis shows improving gross margins as a key positive factor 3. The company demonstrates high operating leverage potential, though currently operating margins remain significantly negative at -49.25% in the trailing twelve-month period 3. R&D investment levels are high at approximately 28% of revenue, supporting innovation but impacting near-term profitability 3.

The path to profitability is improving based on margin expansion trends and operational scale benefits 3. Management has indicated focus on achieving positive EBITDA as the business scales, with gross margin improvements providing operating leverage 2.

Cash Flow Analysis

Cash flow metrics show mixed signals requiring careful monitoring 3. Free cash flow has improved from -$298.4 million in 2023 to -$212.0 million in the trailing twelve-month period, representing a $86.4 million improvement 3. However, the company continues burning substantial cash, with free cash flow margins of -46.85% 3.

caris_quarterly_data.csvGenerated File

Recent fundraising of $168 million in April 2025 and pending IPO proceeds provide financial runway 241. The company has raised approximately $1.86 billion since 2018, demonstrating continued investor confidence despite ongoing losses 2425.

Risk Factors and Considerations

Key Business Risks

Several risk factors could impact future earnings quality 262127. Reimbursement changes represent a medium likelihood, high impact risk that could significantly affect revenue growth 2021. Competitive risks are high likelihood, medium impact as large diagnostics companies expand precision medicine offerings 1617.

Financial risks include cash burn sustainability (medium likelihood, high impact) given the company's current burn rate of approximately $212 million annually 3. Operational risks around scaling the business are low likelihood, medium impact based on the company's demonstrated growth management 11.

Regulatory and Technology Risks

Regulatory risks are generally low likelihood but high impact 2823. FDA regulatory changes could affect future product approvals, though Caris' recent approvals provide regulatory precedent 78. Technology obsolescence risks are low likelihood, high impact, mitigated by the company's continued R&D investment and AI capabilities 929.

Quality of Earnings Assessment Summary

Overall strong quality of earnings profile with most factors rated positively, though some regulatory and cash flow risks remain

Overall quality of earnings assessment reveals a predominantly positive profile with strong revenue quality, improving cost structure, and solid market positioning. Key strengths include sustainable revenue growth, significant margin expansion, strong competitive positioning, and recent regulatory approvals 127. Areas requiring monitoring include cash burn rate, reimbursement coverage evolution, and competitive dynamics 321.

Conclusion and Investment Implications

Caris Life Sciences demonstrates strong quality of earnings characteristics despite current unprofitability. The company's 47% revenue growth, 17-percentage-point gross margin expansion, and improving operational metrics indicate a business model gaining traction in high-growth markets 123. Recent FDA approvals and expanding market opportunities support continued growth prospects 78.

Key investment considerations include the company's substantial addressable market opportunity ($150+ billion growing to $600 billion), differentiated technology platform, and improving unit economics 456. However, investors must carefully monitor cash burn sustainability, competitive dynamics, and reimbursement evolution as critical factors affecting long-term earnings quality 32117.

The pending IPO at a $5.3 billion valuation appears reasonable given the company's growth trajectory, market opportunity, and recent operational improvements, though investors should expect continued volatility as the business scales toward profitability 3031.

- https://www.medtechdive.com/news/Caris-Life-Sciences-files-424M-IPO/750341/

- https://www.fiercebiotech.com/medtech/cancer-tester-caris-life-sciences-go-public-400m-nasdaq-ipo

- https://stockanalysis.com/stocks/cai/financials/

- https://www.precedenceresearch.com/precision-medicine-market

- https://www.fortunebusinessinsights.com/precision-medicine-market-110463

- https://www.pharmiweb.com/press-release/2025-02-11/precision-medicine-market-analysis-forecast-2025-2035

- https://www.carislifesciences.com/about/news-and-media/caris-life-sciences-receives-fda-approval-for-mi-cancer-seek/

- https://ascopost.com/issues/december-10-2024/fda-approves-novel-companion-diagnostic-assay/

- https://www.carislifesciences.com

- https://www.linkedin.com/company/caris-life-sciences

- https://growjo.com/company/Caris_Life_Sciences

- https://thebrandhopper.com/2023/07/08/caris-founders-history-business-and-revenue-model-growth/

- https://www.ainvest.com/news/caris-life-sciences-files-300m-ipo-revenue-50-2505/

- https://www.towardshealthcare.com/insights/liquid-biopsy-an-emerging-cancer-diagnostic

- https://www.marketsandmarkets.com/ResearchInsight/molecular-diagnostic-market.asp

- https://www.mordorintelligence.com/industry-reports/molecular-diagnostics-market/companies

- https://www.cbinsights.com/company/caris-diagnostics/alternatives-competitors

- https://www.onclive.com/view/mi-cancer-seek-receives-fda-approval-as-companion-diagnostic-for-targeted-therapy-across-tumor-types

- https://www.carislifesciences.com/physicians/physician-tests/mi-cancer-seek/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC8651321/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC3555168/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC7574807/

- https://premier-research.com/perspectives/a-different-pace-meeting-the-demands-of-liquid-biopsy-development-for-early-cancer-detection/

- https://www.mobihealthnews.com/news/caris-life-sciences-secures-168m-precision-medicine-platform

- https://www.carislifesciences.com/about/news-and-media/caris-life-sciences-raises-830-million-in-growth-equity-capital-to-continue-to-expand-its-precision-medicine-platform/

- https://www.novopath.com/resources/blog/21-challenges-molecular-diagnostics-labs-face-embracing-the-future-of-medical-science/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC6857715/

- https://www.carislifesciences.com/about/news-and-media/caris-life-sciences-submits-two-pma-applications-to-the-fda-for-whole-exome-and-whole-transcriptome-sequencing/

- https://www.carislifesciences.com/wp-content/uploads/2023/01/Caris-Life-Sciences-Raises-400-Million-Dollars-in-Senior-Secured-Debt.pdf

- https://finance.yahoo.com/news/sixth-street-backed-caris-life-112745993.html

- https://www.reuters.com/business/healthcare-pharmaceuticals/sixth-street-backed-caris-life-sciences-targets-53-billion-valuation-us-ipo-2025-06-09/

- https://www.cbinsights.com/company/caris-diagnostics/financials

- https://www.carislifesciences.com/about/news-and-media/caris-life-sciences-reports-record-setting-2014-year-end-results/

- https://www.fiercebiotech.com/medtech/caris-life-sciences-picks-400m-after-launching-22000-gene-cancer-blood-test

- https://www.carislifesciences.com/about/news-and-media/caris-life-sciences-files-registration-statement-for-proposed-initial-public-offering/

- https://www.prnewswire.com/news-releases/caris-life-sciences-files-registration-statement-for-proposed-initial-public-offering-302464597.html

- https://www.linkedin.com/posts/caris-life-sciences_caris-life-sciences-has-filed-a-registration-activity-7331813925862219779-yqO_

- https://www.tradingcalendar.com/post/cai-ipo

- https://www.streetinsider.com/SEC+Filings/Form+8-A12B+Caris+Life+Sciences,/24936819.html

- https://www.carislifesciences.com/about/news-and-media/caris-life-sciences-announces-launch-of-initial-public-offering/

- https://www.biospace.com/u-s-precision-medicine-market-size-to-hit-usd-76-12-billion-by-2033

- https://www.youtube.com/watch?v=Mj1Z_ehS8N4

- https://www.carislifesciences.com/wp-content/uploads/2024/11/Caris-Life-Sciences-Receives-FDA-Approval-for-MI-Cancer-Seek-as-a-Companion-Diagnostic-CDx-Test-1.pdf

- https://www.justice.gov/usao-edny/pr/caris-life-sciences-pays-over-28-million-settle-false-claims-act-allegations-delay

- https://x.com/carisls?lang=en

- https://www.sec.gov/Archives/edgar/data/2019410/000110465925052381/tm2415719-14_s1.htm

- https://www.streetinsider.com/SEC+Filings/Form+S-1+Caris+Life+Sciences,/24845910.html

- https://www.biospace.com/press-releases/precision-medicine-market-size-to-reach-usd-470-53-billion-by-2034

- https://www.grandviewresearch.com/industry-analysis/precision-medicine-diagnostics-therapeutics-market

- https://www.reuters.com/business/healthcare-pharmaceuticals/caris-life-sciences-discloses-rise-revenue-us-ipo-filing-2025-05-23/

- https://seekingalpha.com/article/4790490-caris-life-sciences-seeks-ipo-on-revenue-growth-high-operating-losses

- https://www.accessdata.fda.gov/scripts/cdrh/cfdocs/cfpma/pma.cfm?id=P240010

- https://www.quantumdx.com/blog/regulatory-challenges-in-molecular-diagnostics-an-overview/

- https://pmc.ncbi.nlm.nih.gov/articles/PMC2329782/

- https://clpmag.com/diagnostic-technologies/molecular-diagnostics/molecular-diagnostics-challenges-and-benefits/

- https://www.globenewswire.com/news-release/2025/05/01/3072699/0/en/Global-Molecular-Diagnostics-Market-to-Expand-at-a-CAGR-of-9-by-2032-Due-to-the-Rising-Demand-for-Precision-Medicine-DelveInsight.html