Is AI-Driven Drug Discovery a Trend or a Bubble? Vice President of a Venture Capital Firm Clarifies}

This article critically examines AI in pharma, discussing its potential, challenges, and whether it represents a real opportunity or a hype bubble, with insights from a VC executive.

In AI for Science, biological foundation models and AI-driven drug discovery are rapidly evolving and attracting significant investment, especially with breakthroughs like AlphaFold and ChatGPT.

For example, in 2023-2024, Nvidia invested in over ten pharmaceutical companies, and Nobel laureate Demis Hassabis’s Isomorphic Labs announced a $600 million funding round in Q1.

This trend is largely driven by AI’s transformative potential in biology and drug development.

Recently, Maggie Basta, Vice President of Scale Venture Partners, published a blog analyzing the future of biological foundation models and exploring value creation in AI-driven drug discovery.

Genomic sequencing, previous AI waves, and numerous biotech trends have attracted investors and entrepreneurs, but complex business models, scalability issues, long ROI cycles, and high risks have caused many to fail.

This does not negate the role of innovative tech in drug discovery, but no mature business model has emerged. Regardless of patents, the core economics and risks of clinical trials remain unavoidable.

The biotech industry progresses slowly, costs are high, and uncertainties abound. Even the most advanced platforms ultimately reveal that value is rooted in tangible assets, not just software.

While AI’s current wave might differ, it’s crucial to question whether AI represents a fundamentally new business opportunity in science software or if traditional biotech economic models will dominate again.

Lessons from drug discovery tools

Software industry struggles

Historically, selling research software alone has failed to generate scale benefits; actual drug development is necessary. Successful software companies like Veeva focus on data management, not on advancing research itself.

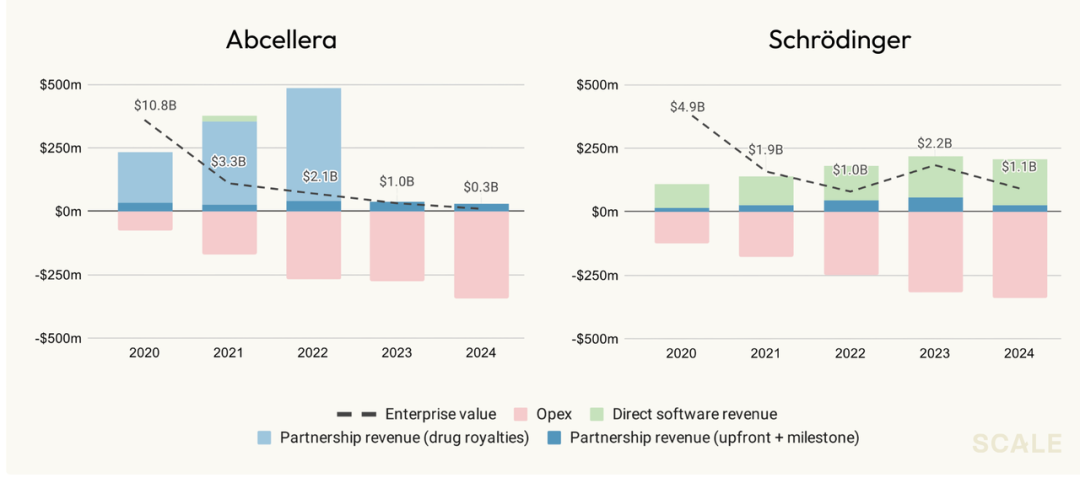

For example, Schrödinger developed widely used computational modeling tools but shifted to in-house drug pipeline development due to insufficient revenue from software alone.

In the early 2000s, after the Human Genome Project, many startups tried to leverage genome data, but the complexity of gene-disease relationships meant that translating data into clinical breakthroughs took years and was too costly for most, leading to failures.

Platform strategies

Biotech startups often adopt platform strategies, focusing on patents and multi-asset generation rather than single therapies, collaborating with big pharma for commercialization. However, most still see the core value in advancing proprietary drug pipelines, often at a loss.

Current AI revolution

Past experiences show that the most direct reason for the surge into AI is technological progress. More subtly, AI may shift the entire business landscape.

From proprietary assets to versatile tools

History proves that selling drug discovery software as a research tool is essentially a vendorization of complex, proprietary R&D processes. The core value lies in translating research into new therapies, which requires drug development or heavy service models.

Modern advanced models can explore unverified discoveries and drug classes, accelerating pipelines, automating costly experiments, and optimizing processes to prevent expensive failures.

AlphaFold 2 marked the first wave, predicting protein structures faster and cheaper than traditional methods like X-ray crystallography, which takes months and costs over $100,000 per structure. AlphaFold reduces this to minutes and minimal cost, greatly lowering experimental costs.

AlphaFold’s secondary effect

Open-sourcing AlphaFold turned a costly bottleneck into a free resource accessible to anyone with a laptop and internet, forcing pharma companies to adapt and build their own technical teams, which may lower barriers for startups entering the field.

Opportunities in biotech

This shift towards practical scientific tools, combined with a mature buyer base, opens numerous possibilities.

Deeper molecular modeling

AlphaFold 2 solved the static protein structure prediction problem, but dynamic interactions—such as how target proteins bind with small molecules or other proteins—require molecular docking, affinity estimation, and molecular dynamics simulations, which go beyond static folding.

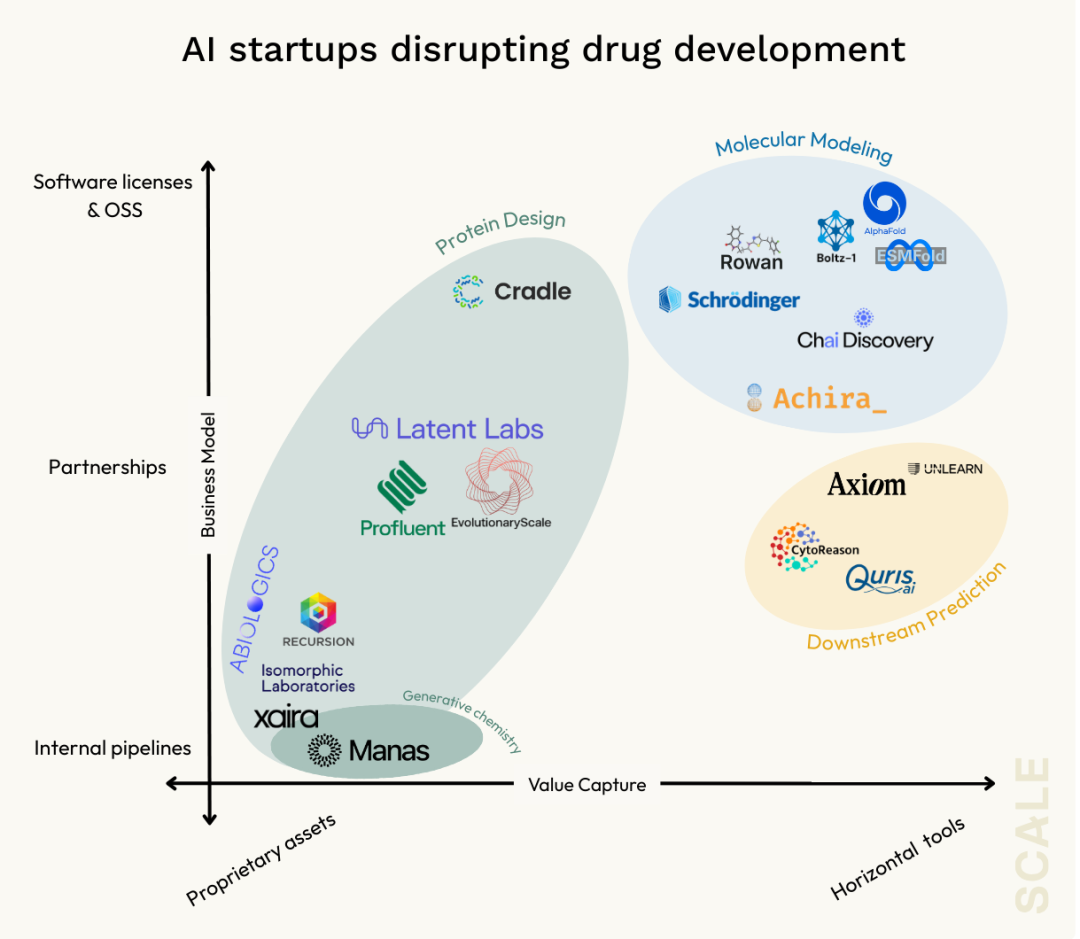

Leading models like AlphaFold 3 and startups like Achira are advancing in this direction, integrating physics and quantum chemistry to improve simulation accuracy.

Schrödinger, with decades in software, realized that building in-house pipelines was necessary for scale, as software alone cannot capture all value. Their core products face competition from open-source tools, with most expenditure on computing power.

Signs suggest this pattern may be changing. AlphaFold 3’s restriction on commercial licensing hints at models becoming more closed, as open-source economics become less viable at large scale.

When models exceed the capacity of buyer infrastructure, full outsourcing to model providers may be the simplest solution.

However, unlike other sectors, biotech benefits from substantial public and non-profit funding for open-source tools, but scaling purely software-based solutions requires standards with significant technological leap.

Downstream prediction and testing

Biomolecular modeling is not the only area where AI has made breakthroughs. A harsh reality is that about 90% of molecules in clinical trials fail, mainly due to efficacy and safety issues that cannot be fully predicted by molecular properties alone.

The market extends beyond pharma—chemical, cosmetic, and agricultural industries also spend heavily on molecular modeling. Buyers often seek simple pass/fail signals rather than proprietary insights, outsourcing most work to cost-effective external providers.

Despite regulatory hurdles, giants like Certara have shown that even as a supplement to traditional methods, AI-driven modeling has a promising market.

Molecular design and de novo discovery

The core of molecular design is shifting towards generating new molecules—whether designing novel biologics with protein models or discovering new small molecules via generative AI.

Companies like Xaira and Isomorphic, with nearly a billion dollars in funding, are adopting in-house pipeline models, while startups like Cradle focus on plug-and-play solutions for mature clients, and Latent Labs and Profluent pursue collaborative development.

Deep integration of AI is a defining feature of this wave. Since biotech companies lack in-house AI talent, startups are expected to play a crucial role.

While AI is transforming the game, it remains asset-intensive. Investors chasing biotech returns through software risk disappointment, but bold players may find enormous opportunities.

Original article link: https://www.scalevp.com/insights/the-future-of-biological-foundation-models-and-value-creation-in-ai-driven-drug-discovery/